The Future of Private Healthcare Practice in the US

This is the third in a series of articles exploring the state of healthcare in the US. Here, we tackle the question "are our perceptions concerning the growth of private healthcare practices accurate?"

As we tackle this new and relevant question, we remember how our first article addressed healthcare’s not-so-out-of-control costs, and how our second broke down the causal relationship between higher prices and exceptional care.

Contributors

Roy Bejarano

Co-Founder & CEO

Brennan Clements

Analyst

Eileen Dai

MBA Intern

Isabella Hanna

MBA Intern

Nicole Zef

MBA Intern

Overview

Most of the time, the whole truth is not as outlandish as a version of or half of the truth. The media is infamous for its capitalization on the sensational parts of a story; consequently, the public falls victim to misinformation and partial coverage. The topic of healthcare is not exempt from these biased practices.

As previously discussed in our paper Healthcare is Not Broken in America, various news outlets prioritize capturing their viewers or readers rather than promoting the distribution of factual information. The social effect created as a result of selective reporting “enhances social coordination as individuals more readily accept the information if they believe others have also accepted it.” (1) As journalists hook their audience with staggering headlines, they further deceive by singling out “shocking” statistics without first giving context. For example, a recent claim highlighted that “2016 marks the first time that physician owners are not the majority,” (2) leaving readers with the impression that private practices across America must be in rapid decline. Nevertheless, the same article then goes on to evaluate the distinction between small and medium to large-sized physician-owned practices, and how the varying sizes of said practices are what is changing, not the rejection of healthcare privatization as a whole.

Private practices are not in decline. They are evolving / metamorphosizing.

Bold claims such as the one previously mentioned have attracted an audience, not an educated or informed viewer/reader base. Yet while foreboding the demise of private practice is a clever journalism tactic, it is not an honest one. Based on deeper analysis, the more accurate truth is that private practices are far from “declining” or “dying”; rather, the landscape of the private healthcare industry is evolving. The first step in reaching this conclusion requires a unified understanding of what exactly constitutes a private practice.

Let's set the definition of private practice straight.

Historically, private healthcare practices were small, family-owned businesses, yet the media refuses to get with the times, continuing to report as if this landscape still currently reflects reality. The understood definition of private practice is established by the American Medical Association (AMA) as “A practice wholly-owned by physicians rather than by a hospital, health system, or other entity.” Evidently, there is no reference to the number of physicians per single practice, degree of shared ownership, size of facility, etc. Instead, the distinction is limited to who owns the practice—a physi-cian or hospital/health system. With no recognition of the variety in private practice, there is room to fabricate an untrue phenomenon. One writer, Emily Dalton, proclaims, “The days when a doctor could show up in a small town, rent an office and hang out a shingle, sadly, is pretty much over.”(3)

By situating one’s argument behind an overly specific type of private practice, journalists mislead people who are unable to decipher between faulty and truthful information. In the example above, Dalton equates private practice with small boutique firms owned by single physicians. Given the AMA’s definition, Dalton’s argument is correct since small family-owned practices are examples of private practices decreasing in popularity. However, a more careful look into this universally accepted defini-tion reveals that Dalton and others neglect to consider that private practices are not only limited to small, family-owned practices but also include medium physician-owned practices and significantly larger non-hospital owned physician conglomerates.

The misused definition of private practice paves the way for another bold assumption: due to private practices’ so-called “bleak state”, independent physicians are leaving this sector in waves. One particular article, citing from the AMA’s Physician Practice Benchmark surveys, claims that “the percentage of physicians who have an ownership stake in their practice dropped from 53% in 2012 to 44% in 2020” and “employed physicians outnumber those in private practice.”(4) These statements imply that being employed and working in private practice are mutually exclusive. Yet, according to the AMA’s definition of private practice, this is not necessarily the case. A physician no longer working for their own small, family-owned business is not synonymous with the “fact” that they do not still work in general private practice. At some point, the debate has to shift away from the poor use of terminology. Until then, the public is bullied into believing an exaggerated narrative.

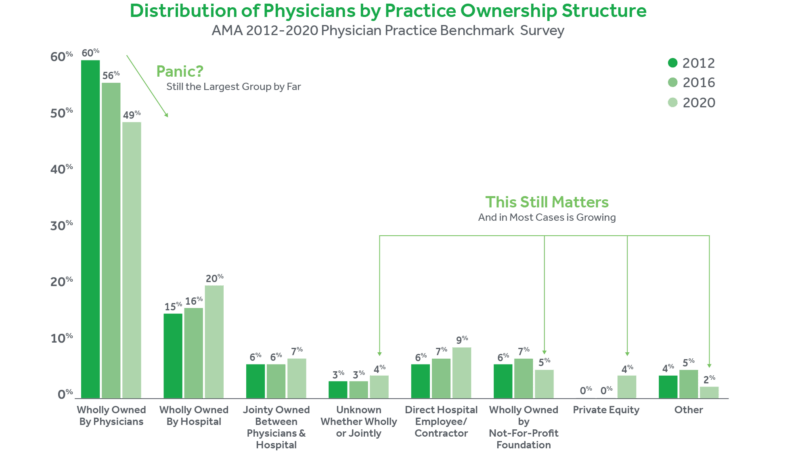

Interestingly enough, data collected by the AMA speaks directly to this discrepancy. Below is the distribution of physicians working for their own practices, for other physicians’ practices, and for larger entities not owned by physicians for the years 2012, 2016, and 2020.

The numbers show that although the fraction of physicians working for private practice is decreas-ing, the media severely overstates the reality due to their flawed definition. For instance, there is the aforementioned statistic that in 2016, less than half of physicians work for their own practice. Since the media considers working in private practice to be working for your own or small family-owned practice, the media interprets this statistic to mean that less than half of physicians work in private practice. Yet the reality is that 55.8% of physicians work for practices wholly owned by physicians, and thus by the AMA’s definition, the majority of physicians work for private practice. Despite the de-crease in 2020, nearly half of physicians still work at a practice wholly owned by physicians, comprising the largest ownership structure with a significant gap between the next greatest ownership structure.

What is actually going on?

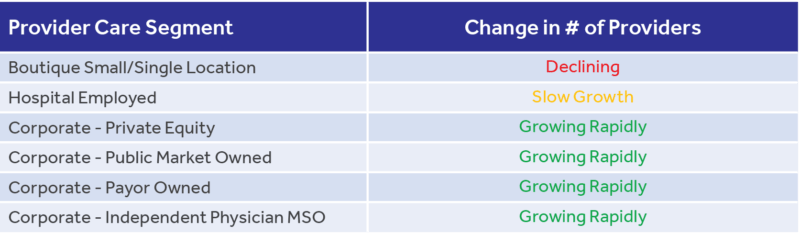

Although single-owned private practices are not as widespread as they once were, it is not disappearing as quickly as the media claims. Instead, the more favored form is corporate practice, or medium to large multi-site conglomerates. This shift mostly took the form of mergers between smaller practices or the consolidation of many practices into a larger entity. As highlighted in the table below, a significant portion of this has been aided by outside capital from investors such as the private equity community, family offices, large insurance payors, and even public markets.

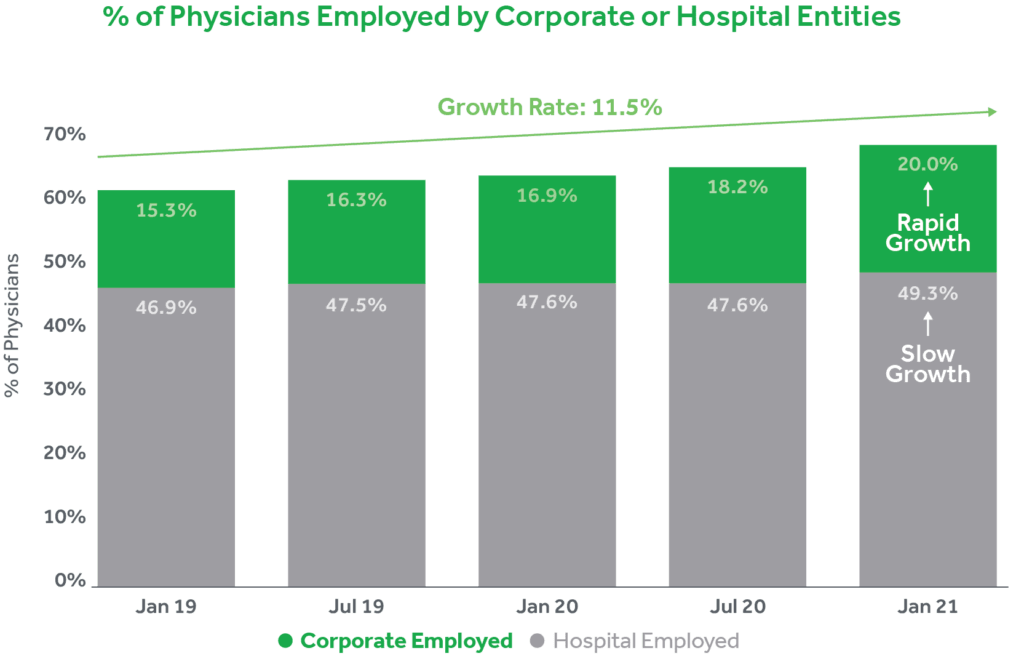

Over the past two years according to Physician Advocacy Institute (5) the growth of corporate-owned practices has skyrocketed. The rate of growth of physicians employed by these provider segments has increased by 11.5% between January 2019 and January 2021; roughly 7 in every 10 physicians now fit into this corporate/hospital-employed bucket. Furthermore, this has all been fueled by increased acquisition activity of physician practices by hospitals and or corporate entities. From 2019 to 2021, acquisitions in this space grew nearly 25%, resulting in relatively equal percentages of corporate and hospital-owned practices. This acquisition pace now nearly accounts for 50% of the market share.

Over the past two years according to Physician Advocacy Institute,5 the growth of corporate-owned practices has skyrocketed. The rate of growth of physicians employed by these provider segments has increased by 11.5% between January 2019 and January 2021; roughly 7 in every 10 physicians now fit into this corporate/hospital-employed bucket. Furthermore, this has all been fueled by increased acquisition activity of physician practices by hospitals and or corporate entities. From 2019 to 2021, acquisitions in this space grew nearly 25%, resulting in relatively equal percentages of corporate and hospital-owned practices. This acquisition pace now nearly accounts for 50% of the market share.

This growth is highlighted by Dr. Joy Liu, founder of Healthy Living Primary Care in California, who experienced this shift firsthand. She recalls that when starting her own practice, she witnessed many small private practices dissolve, but private practice as a whole did not suffer. Those small private practices joined other hospital-owned practices and became part of larger models. Meanwhile, her own practice survived this so-called “death of private practice” and is thriving today, having absorbed some patients from those closed private practices. (3) Healthy Living Primary Care is one example of a small practice that changed instead of “died” despite the message the mass media sends.

Schweiger Dermatology Group is a physician-owned dermatology practice management group from the Northeast. Schweiger is the largest and fastest-growing dermatology group in the Northeast, recently receiving a $100 million investment from a private equity group. As a result, they have faced unparalleled growth and expanded their footprint beyond their current geographical location. Schweiger’s west coast counterpart, California Skin Institute, has also had similar, if not greater, success. Despite being physician-owned, California Skin is one of the largest physician-owned and controlled dermatology practices in the United States.

Health Systems are continuing to consolidate around internal medicine.

It remains important to recognize the scale of continued growth in hospital-owned practices, but it is equally important to understand the relevant context and focus of this trend. Shown below are the top ten largest physician groups within the U.S., defined by number of practice group members, as reported by Definitive Healthcare. (6)

What is important to point out is that nine of the top 10 largest physician groups have “Internal Medicine” cited as their main specialty. So, this isn’t to say that hospitals are not employing a lot of physicians because they clearly continue to be a major employer and acquiror. However, they are primarily focused on Primary Care and Internal Medicine, which creates gaps in areas across specialty care for physician-owned practices to flourish. Hospital-owned specialty care practices are struggling in certain areas and physician-owned groups have actually been able to capitalize on these gaps.

With this context in mind along with the numerous iterations, examples, and experiences of business-owning physicians, this reflects the reality that many choose to ignore—evolution is not synonymous with decline; in actuality, private practice is thriving alongside health systems that are focused elsewhere.

Need equals opportunity.

There is an abundance of opportunities for private practices because there is a need. Evidently, “studies have shown that patients receive higher quality care at a lower medical cost when the care is delivered by independent practices,” leading individuals to feel increasingly distrustful of these larger systems. (8) This sentiment is exactly what private practices can capitalize upon. With higher quality care at lower costs, patients and physicians can create bonds that are long-lasting and profitable. That one-to-one relationship between consistent healthcare providers and satisfied patients cuts out the ineffective, bureaucratic middleman.

When it comes to bureaucracy, hospitals are notorious for their array of committees and various high-ranking officers that are responsible for excessively long turnaround times. However, physicians partners do not have to seek the same level of organizational approval. AMA President Barbara L. McAneny, MD, testifies of her experience transitioning from a hospital to a private setting. “We didn’t have to go through 27 hospital committees and ask permission from a bunch of vice presidents for various things,” she said. “We just sat in a room. The group said, ‘Figure out how to do it. Let’s do it.’ And we did it. It is incredibly rewarding.” (9)

With the foundation of trust laid and effective decision-making practices agreed upon, private practices have the flexibility to cut costs while maintaining profit margins. For example, in a study focusing on unicompartmental knee arthroplasty procedures, results found that cost savings of roughly 50% are achievable with an outpatient UKA protocol done at an outpatient surgical facility. (10) In general, “hospitals treatment will always be the most expensive option for a variety of reasons, including the site of service fees and reimbursement structures.” (11) Again, this highlights the components that are inherent advantages in the private healthcare industry.

Where there is opportunity, there is reward.

Beyond the career benefits to building a private healthcare practice, it is also professionally gratifying; gratification helps sustain patient satisfaction which is worth the long-term investment. This element is not only a huge advantage of private practice, but it is foundational to the success of the industry. When physicians are content with their work, they are that much more prepared to care for their patients. On the other hand, “poor wellbeing and moderate to high levels of burnout are associated, in the majority of studies reviewed, with poor patient safety outcomes such as medical errors.”12 At the end of the day, physicians’ well-being is the lifeline behind a practice.

Fact at its finest.

Fact of the matter is, there is untapped potential in the growing market of private healthcare practic-es. The media may inaccurately portray the state of the healthcare industry; nonetheless, the facts suggest a very different reality. The private practice landscape is evolving and medium to large-sized, physician-owned practices are becoming more abundant and attractive. We at SCALE not only see success as a possibility but a definite outcome as a result of calculated business practices.

Download the PDF

1 https://gap.hks.harvard.edu/how-does-media-influence-social-norms-field-experiment-role-common-knowledge

2 https://www.ama-assn.org/about/research/first-time-physician-practice-owners-are-not-majority

3 https://www.kevinmd.com/blog/2017/06/slow-death-private-practices.html

4 https://thedo.osteopathic.org/2021/05/for-the-first-time-less-than-half-of-physicians-are-in-private-practice-survey-finds/ 5 http://www.physiciansadvocacyinstitute.org/PAI-Research/Physician-Employment-and-Practice-Acquisitions-Trends-2019-20 6 https://www.definitivehc.com/blog/top-10-largest-physician-groups

7 https://www.healthaffairs.org/doi/10.1377/hlthaff.2016.0130

8 https://coworkmedical.org/resources/dear-doctor-here-are-three-reasons-why-private-practice-is-needed/

9 https://www.ama-assn.org/practice-management/private-practices/why-private-practice-should-be-your-radar

10 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5400228/

11 https://health.usnews.com/health-care/for-better/articles/2018-10-30/why-private-practitioners-are-still-the-best-choice-

for-consumers

12 https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0159015